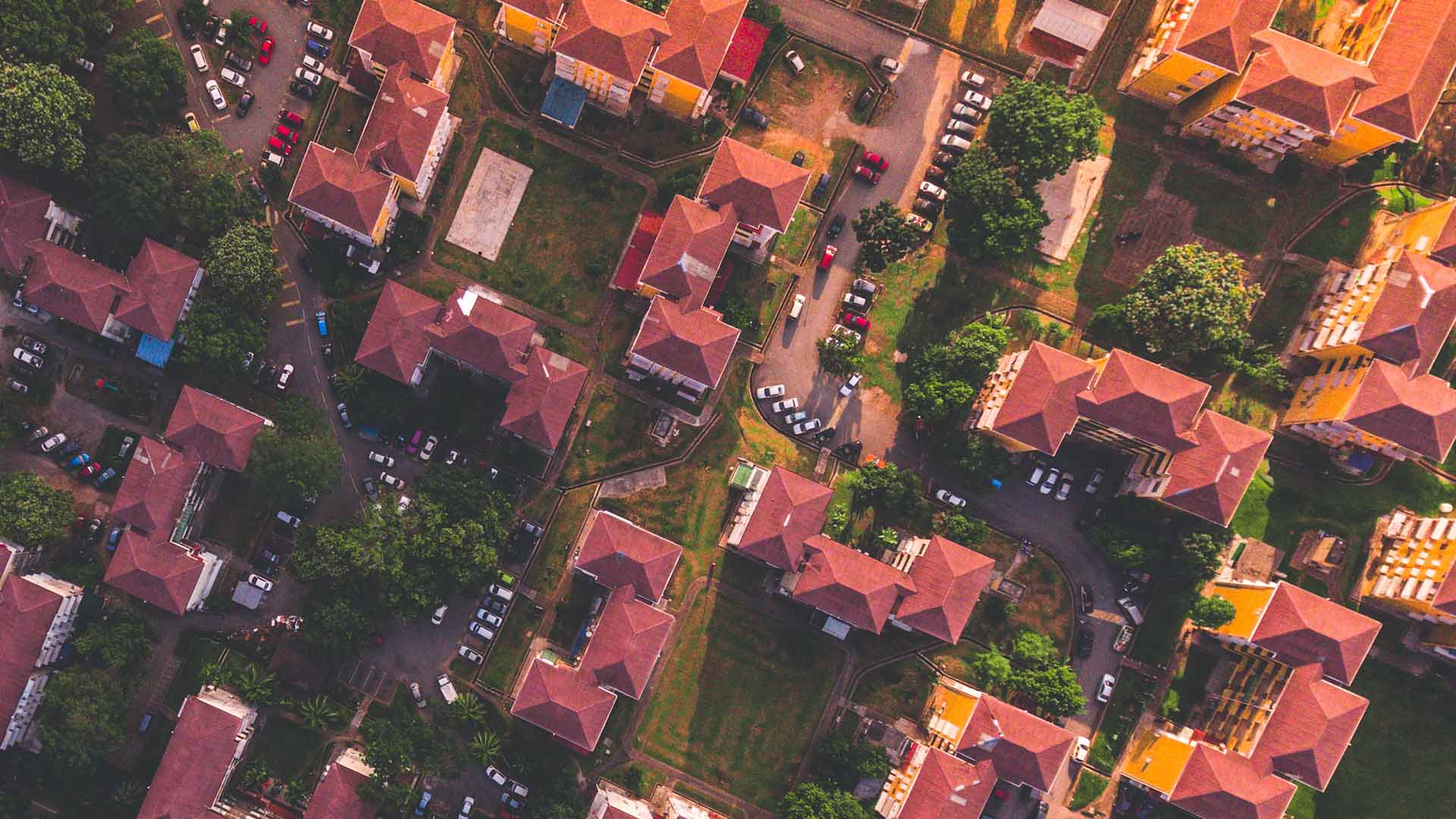

Are you interested in investing in real estate but unsure of the different types of properties available? Real estate investment offers a diverse range of options, each with its advantages and considerations.

Understanding the different types of real estate investment properties is crucial for making informed decisions and maximizing your returns.

Real estate investment has long been a popular choice for individuals looking to build wealth and generate passive income. Whether you are a seasoned investor or a beginner, it’s important to familiarize yourself with the various types of properties available in the market.

From residential properties to commercial buildings and everything in between, there is a wide array of real estate investment options to choose from. Each type of property has its own unique set of benefits and risks, making it essential for investors to understand their characteristics.

In this article, we will explore the different types of real estate investment properties, helping you determine which one suits your investment goals and risk tolerance.

Real Estate

Real estate refers to tangible property, including land, buildings, and natural resources, along with the rights and interests associated with them.

What is Real Estate?

Real estate is a broad and tangible asset class that encompasses physical properties, land, and natural resources, along with the rights and interests associated with them. It is a crucial component of the global economy and plays a vital role in both residential and commercial sectors.

Understanding the fundamentals of real estate is essential for business professionals, investors, and homeowners alike.

Types of Real Estate

1. Residential Properties

Single-Family Homes

Investing in single-family homes is a popular entry point for many real estate investors. These properties offer several advantages, such as ease of management and strong market demand.

By acquiring single-family homes and renting them out, you can generate consistent rental income, enjoy potential tax benefits, and benefit from long-term appreciation of property values. However, it is essential to carefully assess local market conditions, tenant screening processes, and maintenance requirements to ensure successful investment outcomes.

Multi-Family Properties

For business professionals seeking to scale their real estate investments, multi-family properties present an attractive option. Investing in duplexes, triplexes, or apartment buildings allows you to benefit from economies of scale and diversification.

Multi-family properties typically provide a more substantial cash flow potential compared to single-family homes, making them an excellent choice for generating passive income. However, due diligence in evaluating cash flow, tenant profiles, and property management efficiency is essential to ensure successful multi-family property investments.

2. Commercial Properties

Office Buildings

Office buildings offer unique investment prospects, particularly in commercial hubs and prime locations. As a business professional, investing in office buildings allows you to benefit from long-term leases, stable cash flows, and potential capital appreciation.

Careful consideration of tenant creditworthiness, lease terms, and market trends is crucial when analyzing office building investment opportunities.

Retail Properties

Retail properties, including shopping centers and malls, can be lucrative investment options, especially in high-traffic areas. As consumer preferences evolve, investing in retail properties requires a thorough understanding of tenant dynamics, lease structures, and the potential impact of e-commerce on brick-and-mortar retail spaces.

Industrial Properties

With the growing demand for logistics and warehousing, industrial properties have gained prominence in the real estate market. Investing in industrial properties can offer stable rental income and long-term growth prospects, particularly in regions experiencing a surge in e-commerce and supply chain activities.

Understanding local market trends, infrastructure access, and tenant requirements are crucial when evaluating industrial property investments.

3. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) provide a convenient way for business professionals to invest in real estate without direct ownership of properties. REITs are publicly traded entities that pool funds from investors to acquire and manage income-generating properties, such as office buildings, retail centers, and apartments.

Benefits of Investing in REITs

REITs offer several advantages, including liquidity, diversification, and the potential for regular dividend distributions. As a passive investment option, REITs provide exposure to various real estate sectors without the operational responsibilities of direct property ownership.

Understanding Different Types of REITs

REITs come in various types, such as

- Equity REITs

- Mortgage REITs

- Hybrid REITs

each catering to different risk profiles and investment goals.

Analyzing the performance and portfolio composition of different REITs is essential when considering investment options in this asset class.

4. Vacant Land and Development Opportunities

The Value Proposition of Investing in Vacant Land

Investing in vacant land can be a strategic decision, offering the potential for future development, rezoning, or appreciation due to urban growth. Land investments require a thorough analysis of location, infrastructure access, and zoning regulations to unlock their true potential.

Evaluating Development Potential and Risks

Developing properties from scratch can lead to substantial returns, but it also comes with inherent risks. Careful market analysis, cost assessment, and compliance with local regulations are crucial when venturing into development opportunities.

Considering Location, Zoning, and Regulatory Factors

Investing in land and development opportunities necessitates an in-depth understanding of location dynamics, future market projections, and the feasibility of development plans to ensure successful outcomes.

5. Real Estate Crowdfunding and Syndications

The Emergence of Real Estate Crowdfunding Platforms

Real estate crowdfunding platforms provide a way for business professionals to pool funds with other investors for joint ownership of properties. Crowdfunding offers access to various real estate projects with different investment amounts and risk levels.

Benefits and Potential Risks of Participating in Crowdfunding Projects

Crowdfunding allows investors to diversify their real estate portfolios and participate in projects that were previously inaccessible to individual investors. However, understanding the risks, financial projections, and credibility of crowdfunding platforms is crucial for successful investments.

Understanding Syndication Structures and Investor Roles

Real estate syndication involves forming partnerships to finance and manage real estate projects collectively. As a passive investor in a syndicate, it is essential to comprehend the roles and responsibilities of all parties involved.

6. Mixed-Use Properties

The Advantages of Mixed-Use Properties

Mixed-use properties combine residential, commercial, and retail spaces in a single development, offering diversification and synergy between different asset classes. Investing in mixed-use properties provides the opportunity to benefit from multiple income streams and create vibrant community spaces.

Assessing the Synergy between Commercial and Residential Components

Evaluating the compatibility of residential and commercial components within mixed-use properties is essential to ensure a harmonious living and working environment. Proximity to amenities, transportation, and community services plays a crucial role in the success of mixed-use investments.

Analyzing Mixed-Use Property Financing and Management Challenges

Mixed-use properties often require specialized financing and management strategies. Understanding the unique challenges and opportunities associated with mixed-use investments is vital for maximizing returns.

7. Short-Term Rental Properties

The Rise of Short-Term Rental Platforms and the Sharing Economy

The popularity of short-term rental platforms has transformed the vacation rental market. Investing in short-term rental properties offers the potential for high rental income, especially in tourist destinations and cities with strong demand.

Potential Rental Income and Demand Trends

The success of short-term rental properties relies on factors such as location, property amenities, and guest experiences. Analyzing demand trends and regulatory considerations is essential when evaluating short-term rental investments.

Managing the Regulatory Landscape and Guest Experiences

Compliance with local regulations, tax requirements, and maintaining high guest satisfaction are critical aspects of managing short-term rental properties effectively.

8. Niche Real Estate Investment Opportunities

Student Housing

Investing in student housing near universities and colleges can provide stable rental income and long-term demand from the student population.

Senior Living Facilities

The aging population has created a demand for senior living facilities, making them an attractive investment option for business professionals seeking to serve this demographic.

Self-Storage Units

Self-storage units offer a unique investment opportunity with relatively low maintenance and stable rental income potential.

Data Centers

As technology and data demand grow, data centers have emerged as niche investment opportunities with the potential for consistent returns.

Conclusion

As a business professional venturing into real estate investment, understanding the diverse array of real estate opportunities is essential. Each type of real estate investment property comes with its unique benefits, risks, and potential returns.

By conducting thorough research, analyzing market trends, and seeking professional advice, you can make informed decisions to build a diversified and profitable real estate investment portfolio. Whether you choose residential properties, commercial assets, REITs, vacant land, or niche opportunities, the real estate market holds the potential for long-term wealth creation and financial success.