Trending: Here are some Business Statistics and Trends to know

|

Getting your Trinity Audio player ready...

|

The United States economy has been experiencing significant growth in recent years. However, the freight industry has been showing signs of a slowdown. What does this mean for the country's economy as a whole?

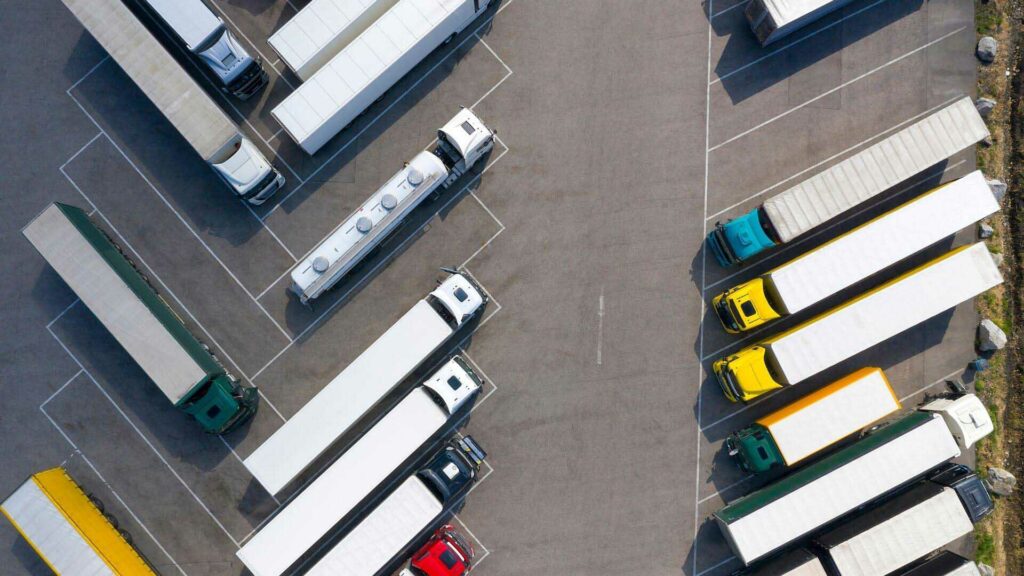

Freight transportation is a crucial component of the economy, as it facilitates the movement of goods and materials across the country. However, in the past few months, there have been reports of a freight recession in the United States. This has left many wondering if this is a temporary setback or a sign of a broader economic downturn.

The United States is facing a freight recession, and it is having a significant impact on the economy. From rising shipping costs to declining demand for goods, the freight industry's struggles are rippling through various sectors.

Freight Recession: Is the US Facing Economic Headwinds?

The U.S. freight industry is experiencing a significant downturn, raising concerns about the state of the economy. In March, truck spot load postings plummeted by 70% compared to the previous year, signaling a decline in freight demand.

This decline has had a particularly severe impact on smaller trucking companies, exacerbating the challenges they already face. Other freight metrics also indicate an economic slowdown, painting a worrying picture for the industry.

Shifting Dynamics: From High Demand to Low Demand

The current situation represents a stark contrast to just a year ago when consumer demand outpaced supply, leading to inventory struggles for retailers. However, the landscape has drastically changed, with an oversupply of trucks and a shortage of available loads.

Todd Spencer, President of the Owner-Operator Independent Drivers Association, highlights the surplus of trucks as a key factor contributing to the reduced freight activity.

Truck Tonnage Index and the Spot Market Impact

The Truck Tonnage Index, a measure of demand, experienced a significant 5.4% decline from the previous month. This drop is the largest monthly decrease since the start of the pandemic in April 2020.

While this index mainly considers contract freight, data suggests that the spot freight market, which is more relied upon by smaller carriers, has been hit even harder. Spot load postings in the past month witnessed a staggering 70% decrease compared to March of the previous year, according to DAT Freight & Analytics.

Struggles for Independent Truckers and the Impact on Diesel Prices

Gordy Reimer, an independent trucker whose business, Freight Horse Express LLC, thrived last year, is now facing a different reality. Multiple parked rigs and unused trailer beds symbolize the current state of reduced demand.

Reimer highlights the drastic decline in spot market rates, with import container prices dropping from $25,000-$30,000 to around $1,000.

As freight demand wanes, diesel prices have also fallen. The average price of diesel currently stands at $4.17 per gallon, down from a record high of $5.82 in June last year. This decrease in diesel prices, coupled with an 8.4% drop in domestic demand, as reported by the Wall Street Journal, further reflects the nation's industrial slowdown.

Signs of a Broader Economic Downturn

Joe Rajkovacz, Director of Governmental Affairs and Communications for the Western States Trucking Association, warns that the decline in diesel demand may be indicative of a more significant issue. Many small business truckers entered the market during its peak, resulting in expensive equipment that they now struggle to maintain.

Some have already been forced out of business. Rajkovacz expresses concerns about the potential impact of recent storms on summer produce, which typically boosts spot trucking rates from regions like California.

Additionally, other freight indicators, such as lower container imports at U.S. ports and a decline in transportation stocks on Wall Street, further suggest an economic slowdown.

Consumer Spending and the Quarter of Minimal Growth

Last quarter, consumer spending experienced the weakest quarterly gain since the onset of the COVID-19 pandemic in the spring of 2020. The 1% annual growth rate, coupled with a four-quarter decline in spending on physical goods like appliances and furniture, contributes to the overall concern about economic conditions.