Argentina's recent presidential election saw libertarian candidate Javier Milei emerge victorious in a closely contested race. Despite this win, the incoming leader faces formidable economic challenges as the nation grapples with severe crises on multiple fronts.

Economic Turmoil: High Inflation, Depleting Reserves, and Impending Recession

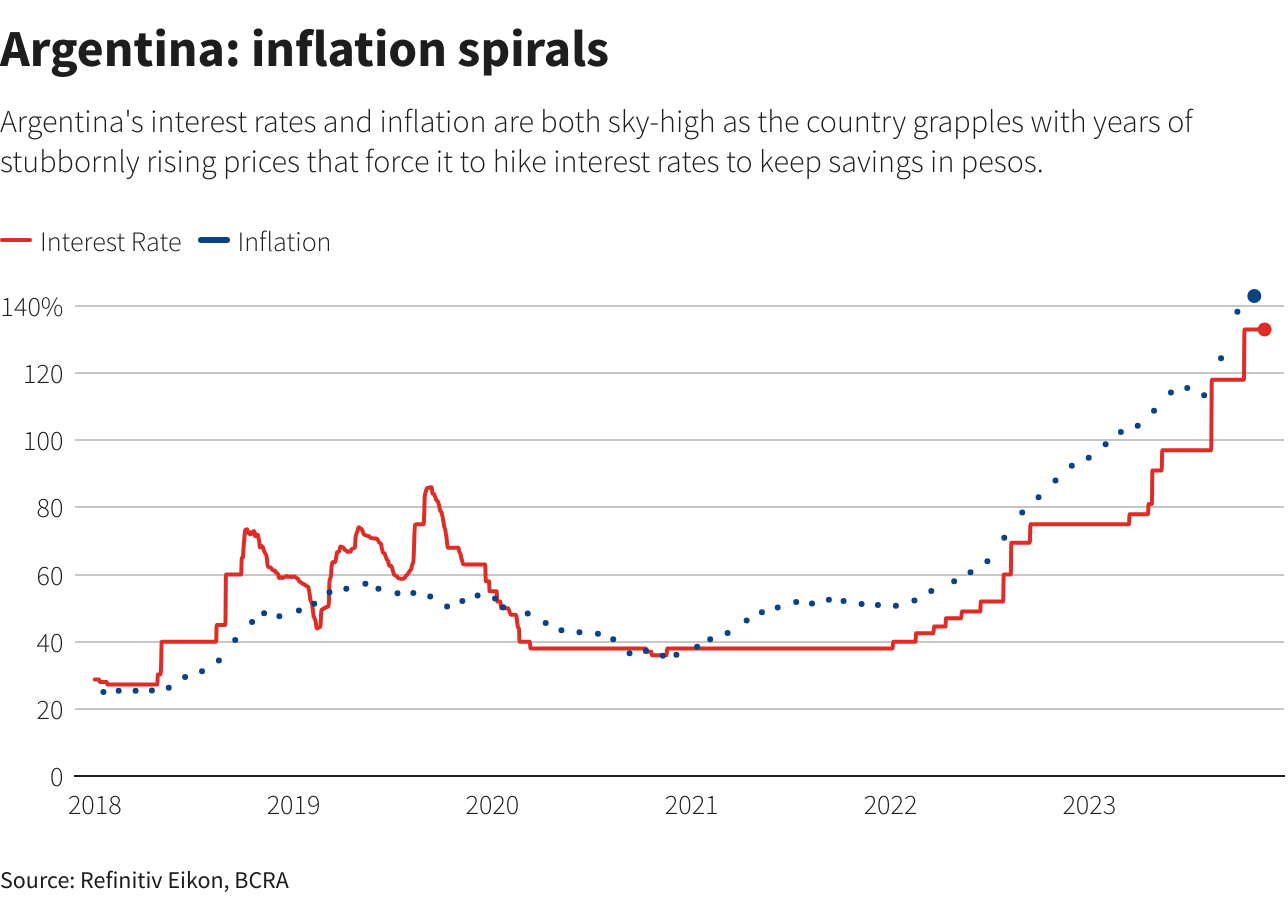

Inflation rates soaring to 143% alongside depleted foreign currency reserves, a plummeting peso, and the ominous threat of recession paint a bleak economic picture. Nearly four in ten Argentines live in poverty, and the specter of a sharp devaluation of the peso looms large, hinting at impending economic upheaval.

Addressing Inflation and Currency Challenges

The nation's high inflation poses significant market distortions and challenges for consumers, leading to frequent and drastic price changes. Experts emphasize the necessity of rectifying this distortion in relative prices to stabilize the economy.

Argentina's central bank has raised the benchmark interest rate to 133%, intending to curb inflation. However, this strategy, while encouraging peso savings, adversely impacts credit accessibility and economic growth.

Peso Control and Multiple Exchange Rates

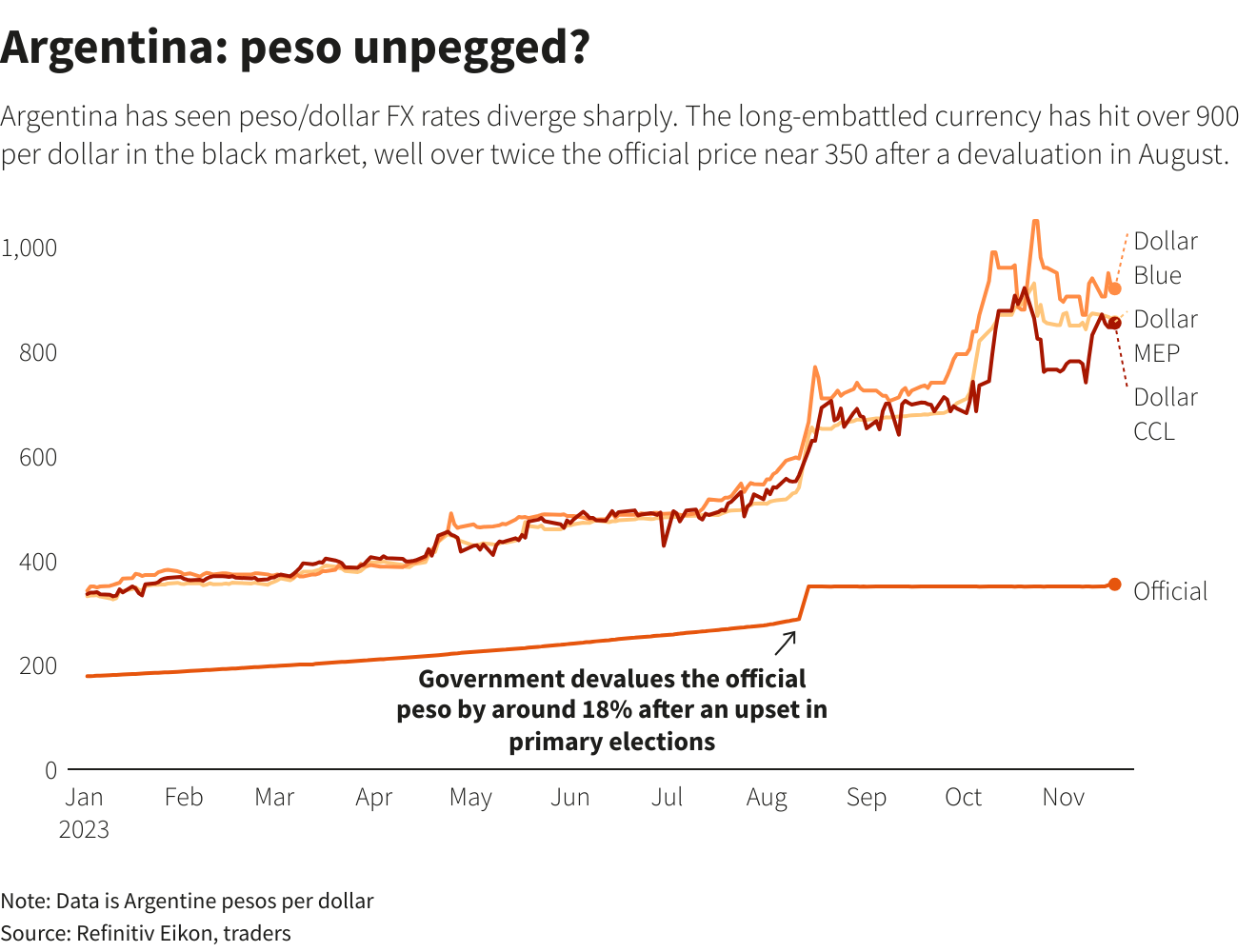

Argentina's currency, the peso, remains restrained by capital controls established after the 2019 market crash. This control has resulted in a labyrinth of exchange rates, with unofficial rates trading dollars significantly higher than the official value.

The emergence of various alternative exchange rates, including the "blue" dollar, MEP, and blue-chip swap, underscores the complexity of the currency situation.

Critical Central Bank Reserves and Recession Indicators

The country's foreign currency reserves, nearly at their lowest since 2006, are perceived as negative in net terms due to a drought impacting key exports like soy, corn, and wheat.

This scarcity in reserves poses risks concerning debt repayment to global creditors and covering crucial imports. Argentina's economy is expected to contract by 2% this year, partly due to the adverse effects of the recent drought.

Silver Linings in the Economic Landscape

Amidst the prevailing challenges, potential brighter spots include an anticipated improvement in harvests due to better rains, a new gas pipeline reducing costly imports, and increased demand for lithium for electric vehicle batteries.

Projections indicate a stronger harvest for soy and corn, a boon for much-needed foreign currency inflow.

While the economic scenario remains grim, potential improvements in agricultural output and burgeoning sectors like shale gas and lithium offer glimpses of hope for Argentina's economic resurgence in the coming year.