Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Steve Bannon warns of a “League of Tyrants” reshaping global power to erode U.S. sovereignty—energy, finance, and domestic division are key leverage points.

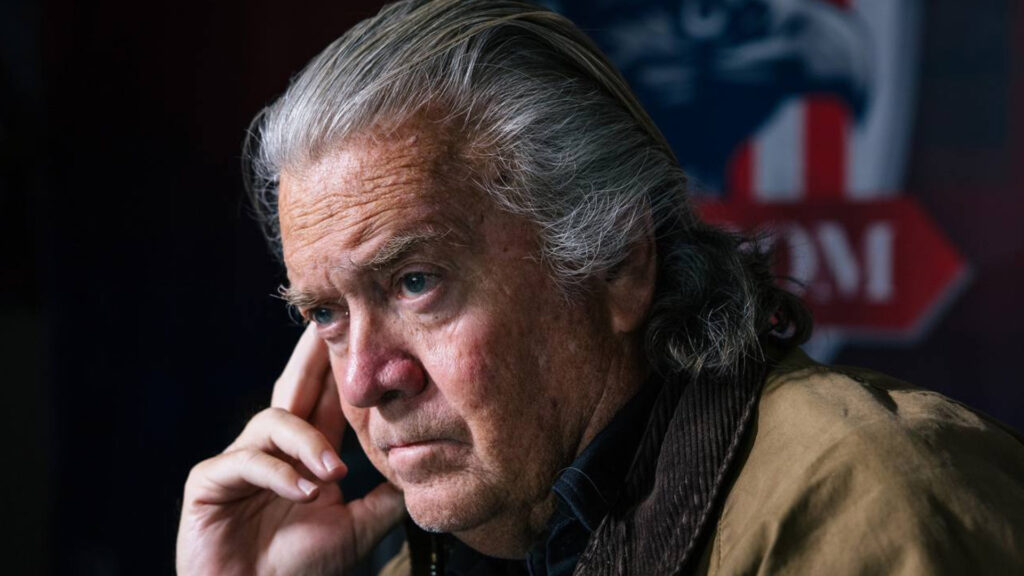

In a recent appearance on The Winston Marshall Show, former White House Chief Strategist Steve Bannon issued a compelling warning about what he calls a “League of Tyrants”—a group of international leaders he claims are working together to undermine American sovereignty and economic stability. His statements, though provocative, speak to growing concerns across political and economic circles about America’s role in a rapidly realigning world order.

Bannon’s commentary offers more than populist rhetoric. It taps into a broader sentiment of strategic unease felt by policymakers, business leaders, and global investors alike, especially as traditional Western dominance faces increasing challenges from emerging powers and alternative alliances.

At the heart of Bannon’s argument is the idea of global coordination among authoritarian and semi-authoritarian regimes. Rather than seeing rising nations as independent actors pursuing national interest, Bannon paints a picture of intentional alignment—a reshaping of the world order with the decline of the United States as the common goal.

“We’re seeing a coordinated restructuring of global power dynamics with America’s decline as a central objective,” Bannon asserts.

This notion isn’t without precedent. The Council on Foreign Relations has tracked how geopolitical rivalries are increasingly playing out in economic arenas—from trade policy to technological standards.

Bannon places significant weight on how trade policy, monetary policy, and supply chain vulnerabilities are eroding U.S. sovereignty. His critique echoes concerns from economists and manufacturers affected by decades of offshoring and foreign currency manipulation.

“GDP growth numbers don’t tell the story of sovereignty,” he says. “When critical industries exist only beyond our borders, growth statistics become meaningless in terms of national security.”

Research from the Economic Policy Institute supports the view that trade deficits and foreign manufacturing reliance can hollow out domestic economic resilience—particularly in strategic industries.

Energy emerges as a central pillar in Bannon’s sovereignty argument. He warns that increasing dependence on foreign energy sources leaves the United States vulnerable to geopolitical coercion.

“Every restriction on domestic energy production creates a corresponding pressure point that can be exploited by international actors.”

This view aligns with findings from the Center for Strategic and International Studies, which has extensively explored how energy dependencies can serve as powerful diplomatic tools for countries like Russia, Iran, and China.

The Biden administration’s climate policy push, while prioritizing sustainability, has drawn criticism from energy security advocates who fear that reducing fossil fuel production too quickly could outpace infrastructure readiness and increase reliance on foreign sources.

One of the more sobering points in Bannon’s analysis is the use of global financial systems as economic weapons. He warns that adversaries could undermine U.S. dominance by selling off Treasury bonds or creating alternative payment systems outside the SWIFT network.

“Financial warfare doesn’t require missiles. A coordinated sale of U.S. Treasury bonds by adversarial nations would create more economic damage than many conventional military actions.”

Recent Atlantic Council analysis confirms growing interest in de-dollarization initiatives, particularly among BRICS nations. These efforts include exploring CBDCs (central bank digital currencies) and bilateral trade agreements in non-dollar terms.

Bannon doesn’t let the American political establishment off the hook. He argues that internal polarization weakens U.S. strategic positioning and provides adversaries with easy points of exploitation.

“Our domestic divisions aren’t merely unfortunate political realities. They’re actively exploited by international actors.”

This concern echoes research from the Brookings Institution, which warns that partisan dysfunction limits America’s ability to maintain a coherent and sustained foreign policy.

The growing perception among international observers is that a fractured America struggles to act decisively, making it easier for coordinated rivals to advance alternative governance and economic models.

Bannon’s thesis is mirrored by current shifts in the global economic architecture. According to the World Economic Forum, globalization is being replaced by “bloc-ization”—where trade, finance, and innovation are increasingly centered within regional spheres of influence.

BlackRock’s Geopolitical Risk Dashboard also reveals how investors now price in geopolitical risks alongside traditional financial fundamentals, leading to what they call a “geopolitical premium” in emerging and developed markets alike.

As America recalibrates its role in this new world, corporate leaders, investors, and policymakers must navigate a reality where sovereignty, economic independence, and global collaboration all coexist in tension.

While Steve Bannon’s warnings are delivered with characteristic urgency, they reflect a real anxiety in the Western strategic community. As global power structures shift and economic warfare evolves beyond tariffs and sanctions, leaders must reconsider how resilience is defined—not just in military terms but across energy, technology, finance, and society.

Whether one agrees with his interpretation or not, Bannon’s podcast is a reminder that global influence is no longer wielded solely through diplomacy or military strength—but increasingly through currency systems, trade corridors, and ideological cohesion.

For businesses, investors, and governments alike, the implications are profound: Sovereignty is being redefined, and those who fail to adapt may find themselves on the wrong side of a rapidly changing global equation.