Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

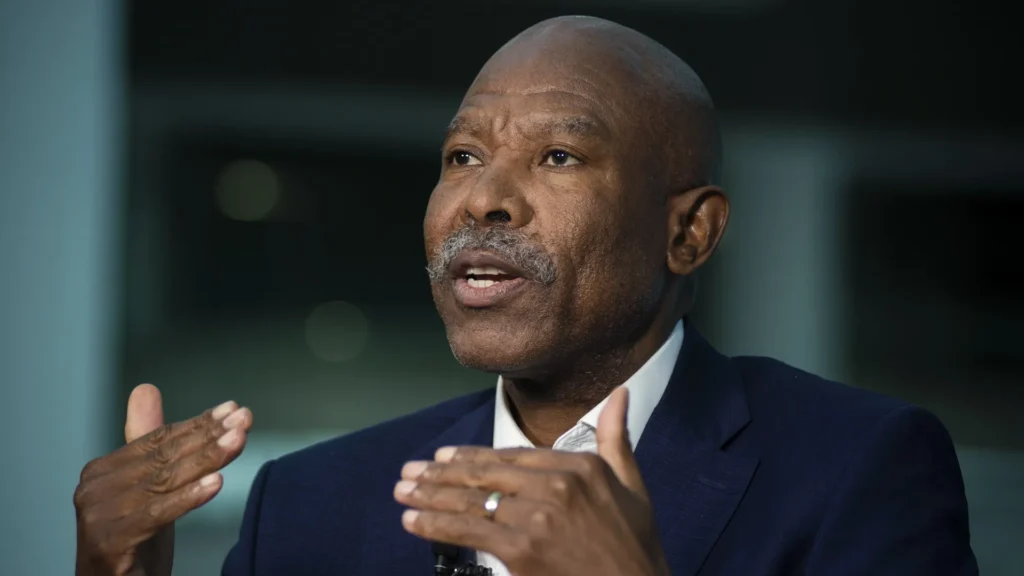

In a candid interview, SARB’s Governor mapped the path ahead: lower‑end inflation targeting, cross‑border payments reform, stablecoin risks and why independence still matters.

Johannesburg – South Africa’s monetary policy has earned global respect for its independence and discipline. In a wide‑ranging interview, the SARB Governor reflected on a tumultuous year; from U.S. tariff shocks and model‑busting currency moves, to inflation‑targeting refinements, the G20 cross‑border payments agenda, and a forthright stance on stablecoins, crypto assets, and monetary sovereignty.

The message was steady: price stability first, pragmatic modernization of payments, and reforms that keep South Africa, SADC, and Africa competitive.

The Governor described a year in which textbook expectations broke. Early in the tariff cycle, the USD strengthened as models predicted; later, it depreciated, softening imported inflation in South Africa.

SARB leaned on scenario planning (e.g., modelling AGOA risks and potential tariffs), accepting that hindsight is perfect but policy must cope with real‑time ambiguity.

While the 3–6% target band remains, SARB now prefers outcomes nearer 3%. That preference—paired with ongoing framework reviews—signals a tighter anchor for expectations, helping reduce the domestic cost of capital over time. The Ministry of Finance and SARB issued coordinated statements after the announcement, underscoring policy cohesion.

From the recent Washington meetings, three broad prescriptions stood out:

These apply squarely to South Africa, where investment requires a lower, stable inflation anchor and a predictable fiscal path.

Under South Africa’s G20 presidency, Finance Track priorities won’t bloat; instead, one Africa‑critical item gets elevated: cross‑border payments. The goal is practical: interoperability between national RTGS and fast‑payment systems so that trade under AfCFTA can be settled efficiently, and remittances from diaspora can move at dramatically lower cost.

SARB co‑chairs the FSB Cross‑Border Payments workstream, reporting progress to the Leaders’ Summit. Regionally, SADC‑RTGS already provides a wholesale backbone; the next step is consumer‑level fast payments and inter‑regional corridors.

South Africa is rewiring its payments ecosystem. Beyond banks, licensed non‑banks will provide remittances and transactions directly, while a national payments utility offers a neutral backbone. Retailers and fintechs bring reach and speed; the public utility helps drive costs down. The fast‑payments push (e.g., PayShap) shows how low‑value, high‑volume transfers can extend digital inclusion and cut cash risk.

SARB draws a firm line: crypto assets are not currencies. Stablecoins can “break the buck,” and USD‑linked tokens risk undermining African currencies, especially where FX is scarce. The solution isn’t prohibition but bringing assets into the regulatory perimeter and reforming domestic fundamentals so citizens trust their own money.

SARB already holds a meaningful gold share of reserves; recent gains boosted headline reserves without new purchases. The global rush into gold reflects two forces: (1) doubts around the safety of “safe” assets amid rising public debt, and (2) the weaponisation of finance, which makes self‑custodied assets attractive. None of this changes SARB’s core point: price stability lowers South Africa’s cost of capital.

Calls for a U.S.‑style dual mandate miss a practical point: SARB lacks the education, labour‑market and wage‑setting tools to run employment policy. The Constitution is explicit: protect the value of the currency in the interests of balanced and sustainable growth. That is how monetary policy supports investment—by anchoring inflation and cutting the hurdle rate.

South Africa’s stance is clear: protect the currency, modernise the rails, and compete globally without sacrificing sovereignty. For business, the play is to price for uncertainty, plug into the new payments corridors, and align treasury, compliance and product roadmaps to a world where trust, speed and cost discipline decide winners.