Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Keynesian economics revolutionized modern economic thought by emphasizing government intervention and spending to manage demand and stabilize growth. This article explains the core principles of Keynesian theory, its impact on recessions, and how it continues to influence policy today.

| Getting your Trinity Audio player ready... |

Have you ever wondered why economies sometimes plunge into recession despite the best efforts of businesses and markets? Or why governments often step in with massive spending programs during economic downturns?

Consider this: during the Great Depression, unemployment in the United States soared to nearly 25%, leaving millions without jobs and hope. What could have prevented such a crisis or at least softened its blow? This is where Keynesian economics comes into play.

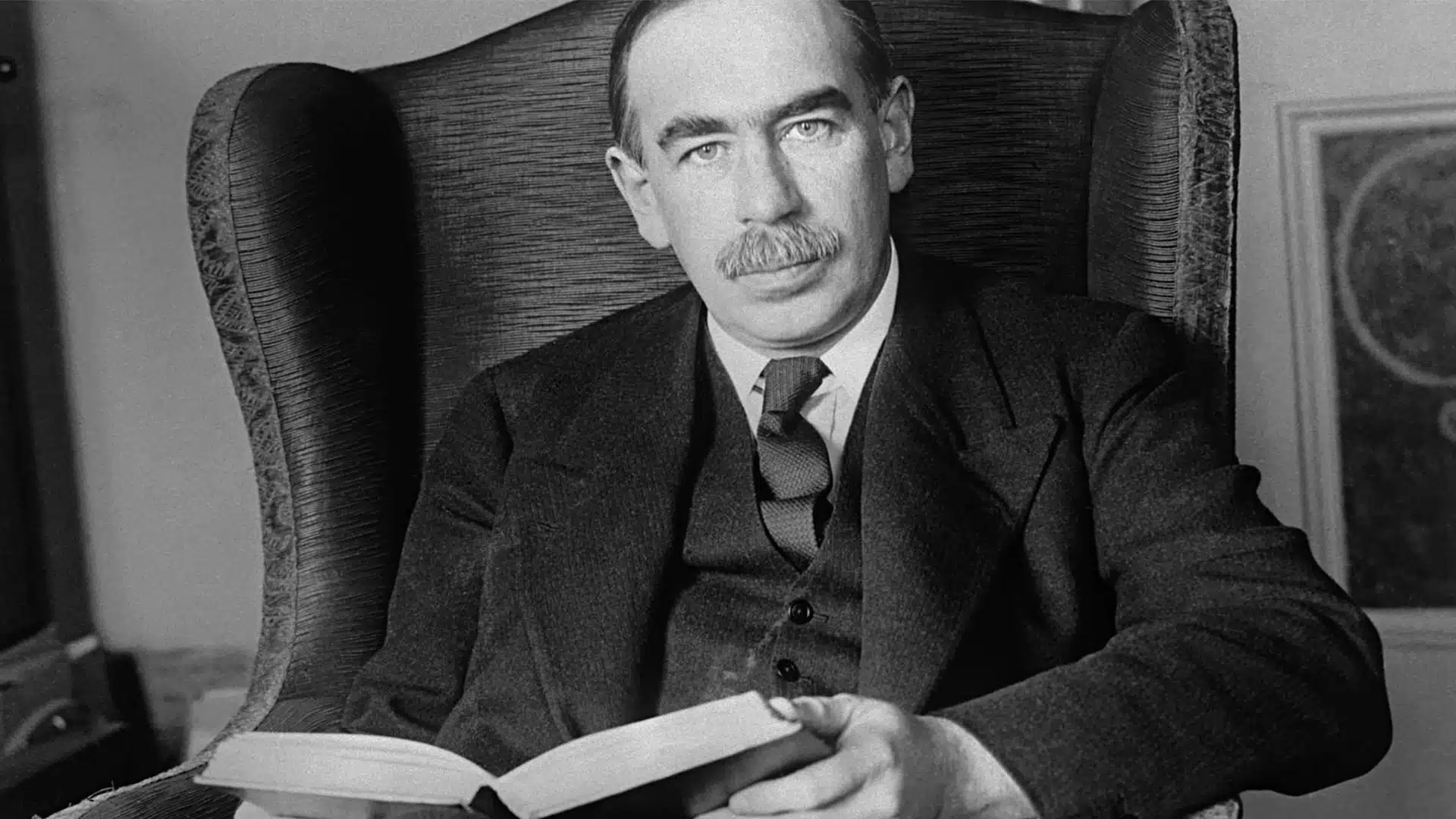

Keynesian economic theory, developed by British economist John Maynard Keynes in the 1930s, challenges the classical belief that free markets always self-correct efficiently. In contrast to the classical school, which emphasizes market self-correction, price flexibility, and skepticism toward government intervention, Keynesian economics advocates for active policy measures during downturns.

According to classical theory, economies tend to return to full employment naturally through flexible wages and prices, assuming that market adjustments alone are sufficient to resolve downturns. Keynes argued that this self-correction does not always occur, especially when aggregate demand collapses, leading to prolonged unemployment and underutilized resources.

Keynes wrote extensively on these issues, and his influential writings have shaped modern economic policy responses to recessions and continue to impact macroeconomic thought today. For example, President Franklin Delano Roosevelt’s (FDR) New Deal programs in the 1930s relied on Keynesian economic principles to combat the Great Depression.

So, what exactly is Keynesian economics, and why should you care about it today? Let’s delve into its core principles, historical context, and practical relevance.

Keynesian economics arose during one of the most turbulent periods in modern history, the Great Depression. As economies around the world grappled with soaring unemployment and stagnant growth, the prevailing classical economic theory failed to offer effective solutions.

Markets did not self-correct as expected, and millions remained out of work. It was in this context that British economist John Maynard Keynes introduced a revolutionary approach, arguing that government intervention was essential to restore economic stability and growth.

Keynesian economics developed during and after the Great Depression from the ideas presented by Keynes in his 1936 book, The General Theory of Employment, Interest and Money. Keynesian economists contended that government spending and proactive fiscal policies could jumpstart economic activity when private sector demand faltered. This marked a significant departure from the hands-off approach of classical economics.

The influence of Keynesian economic theory extended well beyond academia; after World War II, institutions like the International Monetary Fund (IMF) and the World Bank were established, in part, to promote global economic stability using principles rooted in Keynesian thought. The IMF’s advocacy for coordinated fiscal policies and government intervention reflected the widespread acceptance of Keynes’s ideas in shaping the postwar economic order.

Keynesian economics is a macroeconomic theory that emphasizes the role of government intervention, particularly through fiscal policy, to manage aggregate demand and stabilize economic output and inflation.

At its heart, Keynesian economics argues that the economy does not always operate at full employment or optimal output on its own. Instead, fluctuations in aggregate demand (including shifts in consumer demand as a primary driver of economic growth) can cause economic downturns or inflationary booms. Keynesian economists assert that during recessions, private sector demand often falls short, leading to unemployment and unused resources. The principal tenets of Keynesian economics emphasize the importance of aggregate demand, price rigidity, and the critical role of government intervention in stabilizing the economy.

To counteract this, governments should actively intervene by increasing spending, engaging in deficit spending, or cutting taxes to stimulate demand. Keynesian economics advocates that the government needs to spend money during downturns to boost economic growth. This approach leverages the fiscal multiplier, which describes how government spending can have a multiplied effect on aggregate demand and overall economic output.

This approach contrasts sharply with classical economic theory, which posits that markets are self-correcting and that any government interference only distorts natural market adjustments. Keynes challenged this by showing that during severe downturns, such as the Great Depression, market forces alone may be insufficient to restore full employment promptly.

The publication of “The General Theory of Employment, Interest and Money” in 1936 marked a turning point in economic thought. In this groundbreaking work, John Maynard Keynes challenged the core assumptions of classical economic theory, arguing that aggregate demand (not just supply) was the primary driver of economic activity. Keynes proposed that during periods of economic downturn, private sector demand often falls short, leading to unemployment and underutilized resources.

To address these challenges, Keynes advocated for government intervention through fiscal policies such as increased government spending and targeted tax cuts. He introduced the concept of the multiplier effect, which suggests that government expenditures can generate a chain reaction of increased consumption and investment, amplifying the initial impact on the economy. The General Theory laid the foundation for a new way of thinking about economic management, inspiring generations of Keynesian economists and influencing institutions like the IMF to develop models and policies that prioritize aggregate demand and employment. By shifting the focus from supply-side solutions to demand-driven strategies, Keynes’s work fundamentally reshaped the landscape of economic theory and policy.

Keynesian models are built on the principle that aggregate demand is the engine of economic activity. These models highlight the roles of government spending, consumer spending, and investment spending as the main drivers of economic growth.

Keynesian economists use a combination of fiscal policy (such as government expenditures and tax adjustments) and monetary policy, including changes to interest rates and the money supply, to analyze and influence economic trends.

A central concept in Keynesian economic analysis is the Keynesian multiplier, which measures how an initial increase in government spending can lead to a greater overall rise in economic output. This multiplier effect underscores the potential for well-designed fiscal policies to stimulate growth and reduce unemployment, especially during downturns.

By focusing on outcomes like price stability, full employment, and robust economic output, Keynesian models provide policymakers with practical tools and policy prescriptions to manage the business cycle and promote a healthy economic system. These analytical frameworks remain vital for understanding how shifts in aggregate demand can impact everything from gross domestic product to job creation.

Understanding Keynesian economics is crucial for anyone interested in how economic policies shape the world around them. Here’s why:

If you want to leverage Keynesian insights to make smarter economic decisions, here are practical steps to consider:

Keep an eye on consumer spending, government expenditures, and investment trends. These indicators signal shifts in aggregate demand that affect economic growth.

Stay informed about government budgets, stimulus measures, and tax policies. Expansionary fiscal policies, such as increased government spending or tax cuts, often aim to boost demand during slowdowns.

Although Keynesians emphasize fiscal policy, monetary policy (interest rates, money supply)(particularly expansionary monetary policy, which involves lowering interest rates and increasing the money supply to stimulate economic activity) also affects economic activity.

Low interest rates can encourage borrowing and spending, complementing fiscal stimulus.

Recognize where the economy stands in the business cycle; expansion, peak, contraction, or trough. This helps you anticipate policy responses and adjust your strategies accordingly.

During recessions, governments may increase spending on infrastructure, unemployment benefits, or social programs to increase consumer demand and stimulate economic growth. Businesses in affected sectors might see increased opportunities.

Understand that Keynesian policies can lead to increased government debt or inflation risks. Diversify your investments and maintain flexibility to adapt to changing economic conditions.

The influence of John Maynard Keynes on economic thought is both profound and enduring. His ideas laid the groundwork for modern macroeconomics, fundamentally altering how economists and policymakers approach issues of economic growth, full employment, and government intervention.

In the decades following World War II, many governments adopted expansionary fiscal policies inspired by Keynesian economic theory, using government spending to drive recovery and development. Keynesian economics dominated economic theory and policy after World War II until the 1970s, when the emergence of stagflation exposed its limitations.

Keynesian theory has continued to evolve, giving rise to new branches such as New Keynesian economics, which blends elements of classical economics with Keynes’s original insights. Today, Keynesian economists remain at the forefront of policy debates, advocating for active government intervention to counteract economic downturns and maintain stability.

The legacy of Keynes is evident in the ongoing work of institutions like the IMF and in the policy responses to recent crises, where fiscal policies rooted in Keynesian principles have been deployed to support economic growth and safeguard full employment. However, Keynesian theory’s popularity waned during the 1970s due to the emergence of stagflation, a combination of inflation and stagnant growth, which exposed challenges in its application.

While Keynesian economics has shaped much of modern economic policy, it has not been without its detractors. Monetarist economists, most notably Milton Friedman, have argued that monetary policy (managing the money supply and interest rates) is more effective than fiscal policy in stabilizing the economy.

Critics also contend that Keynesian economics can oversimplify the complexities of economic systems, sometimes overlooking the importance of supply-side factors in driving long-term economic growth.

Some economists challenge the Keynesian assumption of a stable equilibrium, pointing out that real-world economies are subject to periodic shortages, surpluses, and unpredictable shocks. In response, Keynesian economists have developed new models, such as those in the New Keynesian school, which integrate aspects of classical economics and recognize the role of supply-side dynamics.

Despite these ongoing debates, the discussion between Keynesian and classical economists continues to enrich economic analysis, offering diverse perspectives on the appropriate balance between government intervention, fiscal policy, and monetary policy in managing economic growth and stability.

The main idea is that aggregate demand drives economic output and employment, and that government intervention through fiscal policy is necessary to stabilize the economy during downturns by addressing economic problems such as unemployment and business cycles.

Government spending increases aggregate demand, which can stimulate production and employment, especially when private sector demand is weak. Often, this spending is financed through government borrowing, particularly during economic downturns.

Increased government spending can impact government finances by expanding the budget deficit. Additionally, government borrowing may raise interest rates, potentially crowding out private investment. By injecting more money into the economy, government spending helps boost demand and support economic recovery.

It is the concept that an initial increase in government spending leads to a larger overall increase in economic output due to the ripple effect of increased consumption and investment spending. The strength of this multiplier effect depends on the marginal propensity to consume; how much of each additional dollar of income households are likely to spend rather than save.

Because classical economic theories failed to explain the prolonged unemployment and economic stagnation, many economists were dissatisfied with classical explanations for these persistent problems. Keynesian economics offered a new framework advocating active government intervention.

Classical economics believes markets self-correct efficiently without government intervention, while Keynesian economics argues that active fiscal and monetary policies are needed to manage aggregate demand and stabilize the economy. Other economists, such as monetarists and the new classical school, offer alternative economic perspectives, challenging Keynesian ideas and emphasizing different mechanisms for economic stability.

Classical economics emphasizes the role of natural resources as a key factor of production, alongside entrepreneurship, capital goods, and labor, and highlights the importance of their efficient use in maximizing profit within a free-market framework.

The new classical school, in particular, stresses rational expectations, quick market adjustments, and skepticism about the effectiveness of policy interventions, contrasting with Keynesian perspectives on price rigidity, persistent unemployment, and the role of government intervention.

Yes, if government spending increases excessively during periods of abundant demand-side growth, it can lead to inflationary pressures.

A liquidity trap occurs when low interest rates fail to stimulate borrowing and spending, limiting the effectiveness of monetary policy and necessitating fiscal stimulus.

Keynesian theory sees unemployment as a result of insufficient aggregate demand and advocates government measures to stimulate employment and stabilize wages.

Absolutely. Many governments use Keynesian-inspired fiscal stimulus during economic crises, including the 2008 financial crisis and the COVID-19 pandemic recession.

By understanding economic cycles and government policies, you can better time investments, anticipate market shifts, and manage risks related to inflation or unemployment.